Page 13 - CFA Lecture Day 10 Slides

P. 13

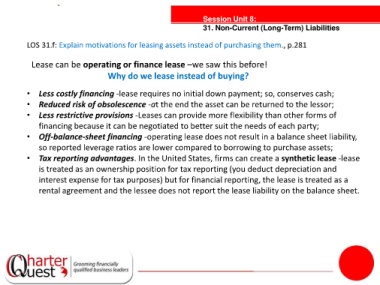

Session Unit 8:

31. Non-Current (Long-Term) Liabilities

LOS 31.f: Explain motivations for leasing assets instead of purchasing them., p.281

Lease can be operating or finance lease –we saw this before!

Why do we lease instead of buying?

• Less costly financing -lease requires no initial down payment; so, conserves cash;

• Reduced risk of obsolescence -at the end the asset can be returned to the lessor;

• Less restrictive provisions -Leases can provide more flexibility than other forms of

tanties

financing because it can be negotiated to better suit the needs of each party;

• Off-balance-sheet financing -operating lease does not result in a balance sheet liability,

so reported leverage ratios are lower compared to borrowing to purchase assets;

• Tax reporting advantages. In the United States, firms can create a synthetic lease -lease

is treated as an ownership position for tax reporting (you deduct depreciation and

interest expense for tax purposes) but for financial reporting, the lease is treated as a

rental agreement and the lessee does not report the lease liability on the balance sheet.