Page 15 - P6 Slide Taxation - Lecture Day 4

P. 15

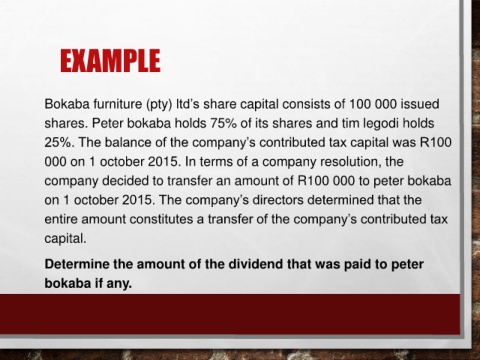

EXAMPLE

Bokaba furniture (pty) ltd’s share capital consists of 100 000 issued

shares. Peter bokaba holds 75% of its shares and tim legodi holds

25%. The balance of the company’s contributed tax capital was R100

000 on 1 october 2015. In terms of a company resolution, the

company decided to transfer an amount of R100 000 to peter bokaba

on 1 october 2015. The company’s directors determined that the

entire amount constitutes a transfer of the company’s contributed tax

capital.

Determine the amount of the dividend that was paid to peter

bokaba if any.