Page 36 - P6 Slide Taxation - Lecture Day 4

P. 36

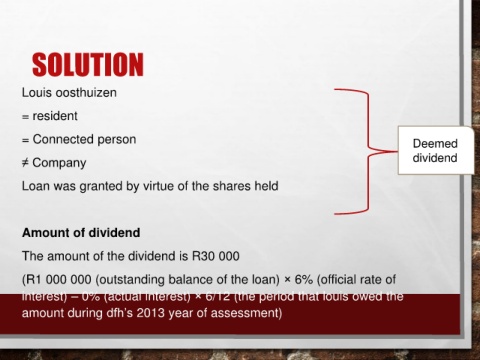

SOLUTION

Louis oosthuizen

= resident

= Connected person Deemed

≠ Company dividend

Loan was granted by virtue of the shares held

Amount of dividend

The amount of the dividend is R30 000

(R1 000 000 (outstanding balance of the loan) × 6% (official rate of

interest) – 0% (actual interest) × 6/12 (the period that louis owed the

amount during dfh’s 2013 year of assessment)