Page 73 - P6 Slide Taxation - Lecture Day 4

P. 73

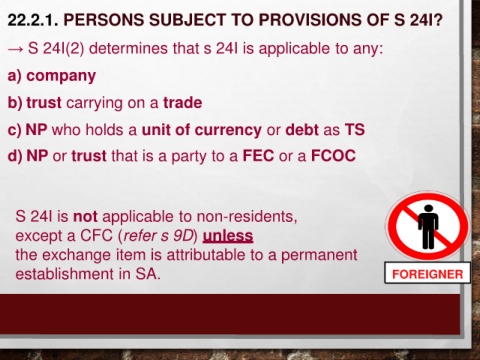

22.2.1. PERSONS SUBJECT TO PROVISIONS OF S 24I?

→ S 24I(2) determines that s 24I is applicable to any:

a) company

b) trust carrying on a trade

c) NP who holds a unit of currency or debt as TS

d) NP or trust that is a party to a FEC or a FCOC

S 24I is not applicable to non-residents,

except a CFC (refer s 9D) unless

the exchange item is attributable to a permanent

establishment in SA. FOREIGNER