Page 52 - FINAL CFA SLIDES DECEMBER 2018 DAY 14

P. 52

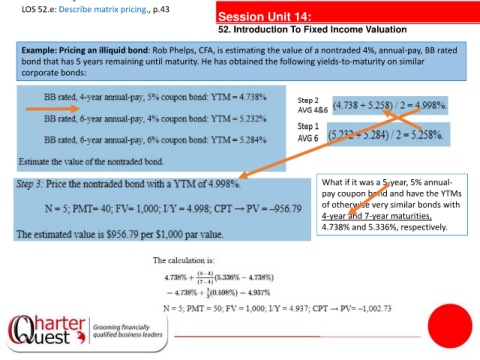

LOS 52.e: Describe matrix pricing., p.43

Session Unit 14:

52. Introduction To Fixed Income Valuation

Example: Pricing an illiquid bond: Rob Phelps, CFA, is estimating the value of a nontraded 4%, annual-pay, BB rated

bond that has 5 years remaining until maturity. He has obtained the following yields-to-maturity on similar

corporate bonds:

tanties

What if it was a 5-year, 5% annual-

pay coupon bond and have the YTMs

of otherwise very similar bonds with

4-year and 7-year maturities,

4.738% and 5.336%, respectively.