Page 17 - CFA Lecture Day 9 Slides

P. 17

Session Unit 8:

28. Inventories

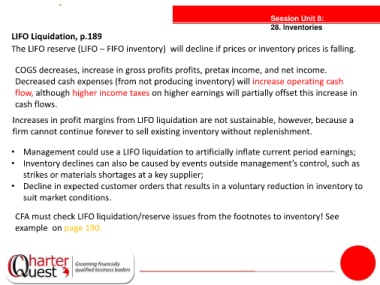

LIFO Liquidation, p.189

The LIFO reserve (LIFO – FIFO inventory) will decline if prices or inventory prices is falling.

COGS decreases, increase in gross profits profits, pretax income, and net income.

Decreased cash expenses (from not producing inventory) will increase operating cash

flow, although higher income taxes on higher earnings will partially offset this increase in

cash flows.

tanties

Increases in profit margins from LIFO liquidation are not sustainable, however, because a

firm cannot continue forever to sell existing inventory without replenishment.

• Management could use a LIFO liquidation to artificially inflate current period earnings;

• Inventory declines can also be caused by events outside management’s control, such as

strikes or materials shortages at a key supplier;

• Decline in expected customer orders that results in a voluntary reduction in inventory to

suit market conditions.

CFA must check LIFO liquidation/reserve issues from the footnotes to inventory! See

example on page 190.