Page 283 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 283

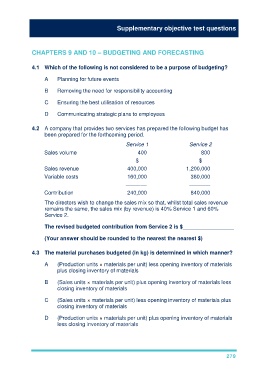

Supplementary objective test questions

CHAPTERS 9 AND 10 – BUDGETING AND FORECASTING

4.1 Which of the following is not considered to be a purpose of budgeting?

A Planning for future events

B Removing the need for responsibility accounting

C Ensuring the best utilisation of resources

D Communicating strategic plans to employees

4.2 A company that provides two services has prepared the following budget has

been prepared for the forthcoming period.

Service 1 Service 2

Sales volume 400 800

$ $

Sales revenue 400,000 1,200,000

Variable costs 160,000 360,000

––––––– –––––––

Contribution 240,000 840,000

The directors wish to change the sales mix so that, whilst total sales revenue

remains the same, the sales mix (by revenue) is 40% Service 1 and 60%

Service 2.

The revised budgeted contribution from Service 2 is $_________________

(Your answer should be rounded to the nearest the nearest $)

4.3 The material purchases budgeted (in kg) is determined in which manner?

A (Production units × materials per unit) less opening inventory of materials

plus closing inventory of materials

B (Sales units × materials per unit) plus opening inventory of materials less

closing inventory of materials

C (Sales units × materials per unit) less opening inventory of materials plus

closing inventory of materials

D (Production units × materials per unit) plus opening inventory of materials

less closing inventory of materials

279