Page 44 - PowerPoint Presentation

P. 44

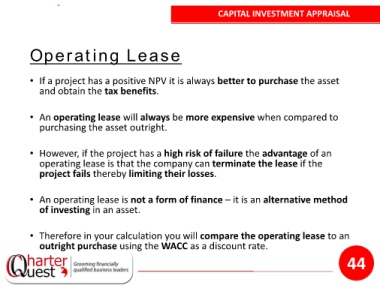

CAPITAL INVESTMENT APPRAISAL

Operating Lease

• If a project has a positive NPV it is always better to purchase the asset

and obtain the tax benefits.

• An operating lease will always be more expensive when compared to

purchasing the asset outright.

• However, if the project has a high risk of failure the advantage of an

operating lease is that the company can terminate the lease if the

project fails thereby limiting their losses.

• An operating lease is not a form of finance – it is an alternative method

of investing in an asset.

• Therefore in your calculation you will compare the operating lease to an

outright purchase using the WACC as a discount rate.

44