Page 37 - F6 Slide - Taxation - Lecture Day 2 Class

P. 37

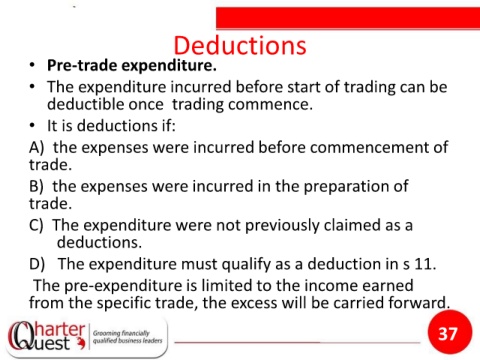

Deductions

• Pre-trade expenditure.

• The expenditure incurred before start of trading can be

deductible once trading commence.

• It is deductions if:

A) the expenses were incurred before commencement of

trade.

B) the expenses were incurred in the preparation of

trade.

C) The expenditure were not previously claimed as a

deductions.

D) The expenditure must qualify as a deduction in s 11.

The pre-expenditure is limited to the income earned

from the specific trade, the excess will be carried forward.

37