Page 8 - FINAL CFA SLIDES DECEMBER 2018 DAY 6

P. 8

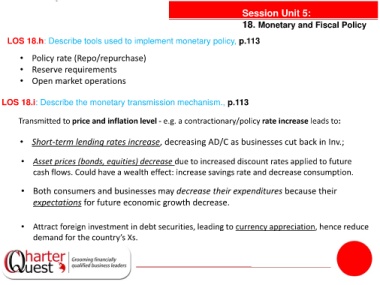

Session Unit 5:

18. Monetary and Fiscal Policy

LOS 18.h: Describe tools used to implement monetary policy, p.113

• Policy rate (Repo/repurchase)

• Reserve requirements

• Open market operations

LOS 18.i: Describe the monetary transmission mechanism., p.113

Transmitted to price and inflation level - e.g. a contractionary/policy rate increase leads to:

• Short-term lending rates increase, decreasing AD/C as businesses cut back in Inv.;

• Asset prices (bonds, equities) decrease due to increased discount rates applied to future

cash flows. Could have a wealth effect: increase savings rate and decrease consumption.

• Both consumers and businesses may decrease their expenditures because their

expectations for future economic growth decrease.

• Attract foreign investment in debt securities, leading to currency appreciation, hence reduce

demand for the country’s Xs.