Page 79 - Test 1 Slides - 4. Gross Income

P. 79

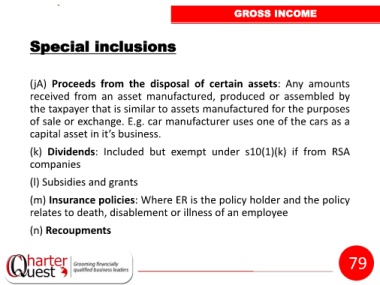

GROSS INCOME

Special inclusions

(jA) Proceeds from the disposal of certain assets: Any amounts

received from an asset manufactured, produced or assembled by

the taxpayer that is similar to assets manufactured for the purposes

of sale or exchange. E.g. car manufacturer uses one of the cars as a

capital asset in it’s business.

(k) Dividends: Included but exempt under s10(1)(k) if from RSA

companies

(l) Subsidies and grants

(m) Insurance policies: Where ER is the policy holder and the policy

relates to death, disablement or illness of an employee

(n) Recoupments

79