Page 322 - AFM Integrated Workbook STUDENT S18-J19

P. 322

Chapter 15

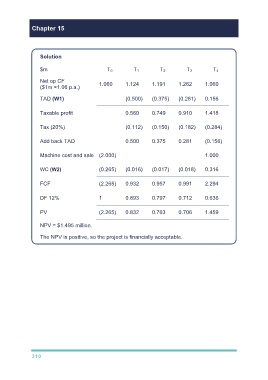

Solution

$m T 0 T 1 T 2 T 3 T 4

Net op CF 1.060 1.124 1.191 1.262 1.060

($1m ×1.06 p.a.)

TAD (W1) (0.500) (0.375) (0.281) 0.156

Taxable profit 0.560 0.749 0.910 1.418

Tax (20%) (0.112) (0.150) (0.182) (0.284)

Add back TAD 0.500 0.375 0.281 (0.156)

Machine cost and sale (2.000) 1.000

WC (W2) (0.265) (0.016) (0.017) (0.018) 0.316

FCF (2.265) 0.932 0.957 0.991 2.294

DF 12% 1 0.893 0.797 0.712 0.636

PV (2.265) 0.832 0.763 0.706 1.459

NPV = $1.495 million.

The NPV is positive, so the project is financially acceptable.

310