Page 331 - AFM Integrated Workbook STUDENT S18-J19

P. 331

Answers

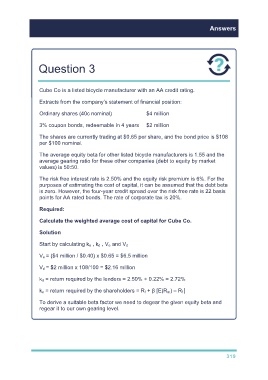

Question 3

Cube Co is a listed bicycle manufacturer with an AA credit rating.

Extracts from the company’s statement of financial position:

Ordinary shares (40c nominal) $4 million

3% coupon bonds, redeemable in 4 years $2 million

The shares are currently trading at $0.65 per share, and the bond price is $108

per $100 nominal.

The average equity beta for other listed bicycle manufacturers is 1.55 and the

average gearing ratio for these other companies (debt to equity by market

values) is 50:50.

The risk free interest rate is 2.50% and the equity risk premium is 6%. For the

purposes of estimating the cost of capital, it can be assumed that the debt beta

is zero. However, the four-year credit spread over the risk free rate is 22 basis

points for AA rated bonds. The rate of corporate tax is 20%.

Required:

Calculate the weighted average cost of capital for Cube Co.

Solution

Start by calculating k e , k d , V e and V d

V e = ($4 million / $0.40) x $0.65 = $6.5 million

V d = $2 million x 108/100 = $2.16 million

k d = return required by the lenders = 2.50% + 0.22% = 2.72%

k e = return required by the shareholders = R f + β [E(R m) – R f ]

To derive a suitable beta factor we need to degear the given equity beta and

regear it to our own gearing level.

319