Page 355 - AFM Integrated Workbook STUDENT S18-J19

P. 355

Answers

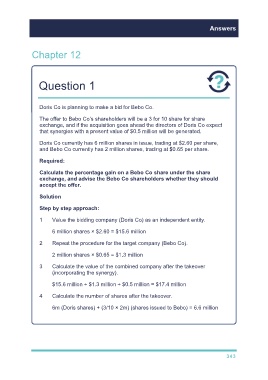

Chapter 12

Question 1

Doris Co is planning to make a bid for Bebo Co.

The offer to Bebo Co’s shareholders will be a 3 for 10 share for share

exchange, and if the acquisition goes ahead the directors of Doris Co expect

that synergies with a present value of $0.5 million will be generated.

Doris Co currently has 6 million shares in issue, trading at $2.60 per share,

and Bebo Co currently has 2 million shares, trading at $0.65 per share.

Required:

Calculate the percentage gain on a Bebo Co share under the share

exchange, and advise the Bebo Co shareholders whether they should

accept the offer.

Solution

Step by step approach:

1 Value the bidding company (Doris Co) as an independent entity.

6 million shares × $2.60 = $15.6 million

2 Repeat the procedure for the target company (Bebo Co).

2 million shares × $0.65 = $1.3 million

3 Calculate the value of the combined company after the takeover

(incorporating the synergy).

$15.6 million + $1.3 million + $0.5 million = $17.4 million

4 Calculate the number of shares after the takeover.

6m (Doris shares) + (3/10 × 2m) (shares issued to Bebo) = 6.6 million

343