Page 157 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 157

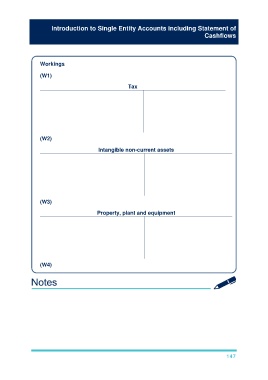

Introduction to Single Entity Accounts including Statement of

Cashflows

Workings

(W1)

Tax

Bank (Bal Fig) 5 Bal b/d (current) 27

Bal c/d 46 SPL 24

–– ––

51 51

–– ––

(W2)

Intangible non-current assets

Bal b/d 234 Amortisation 7

Bank (Bal fig) 50 Bal c/d 277

––– –––

284 284

––– –––

(W3)

Property, plant and equipment

Bal b/d 600 Dep’n 22

Revaluation 251 Disposal 424

Bank (Bal fig) 618 Bal c/d 1,023

––––– ––––

1,469 1,469

––––– ––––

(W4) 25 million × ($2.80 + 0.20) = $75 million

147