Page 3 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 3

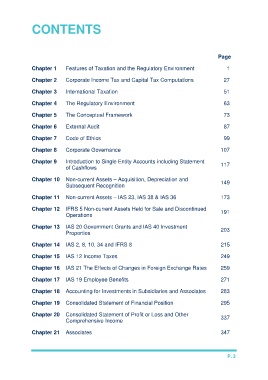

CONTENTS

Page

Chapter 1 Features of Taxation and the Regulatory Environment 1

Chapter 2 Corporate Income Tax and Capital Tax Computations 27

Chapter 3 International Taxation 51

Chapter 4 The Regulatory Environment 63

Chapter 5 The Conceptual Framework 73

Chapter 6 External Audit 87

Chapter 7 Code of Ethics 99

Chapter 8 Corporate Governance 107

Chapter 9 Introduction to Single Entity Accounts including Statement 117

of Cashflows

Chapter 10 Non-current Assets – Acquisition, Depreciation and 149

Subsequent Recognition

Chapter 11 Non-current Assets – IAS 23, IAS 38 & IAS 36 173

Chapter 12 IFRS 5 Non-current Assets Held for Sale and Discontinued 191

Operations

Chapter 13 IAS 20 Government Grants and IAS 40 Investment 203

Properties

Chapter 14 IAS 2, 8, 10, 34 and IFRS 8 215

Chapter 15 IAS 12 Income Taxes 249

Chapter 16 IAS 21 The Effects of Changes in Foreign Exchange Rates 259

Chapter 17 IAS 19 Employee Benefits 271

Chapter 18 Accounting for Investments in Subsidiaries and Associates 283

Chapter 19 Consolidated Statement of Financial Position 295

Chapter 20 Consolidated Statement of Profit or Loss and Other 337

Comprehensive Income

Chapter 21 Associates 347

P.3