Page 477 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 477

Answers

Chaapter 116

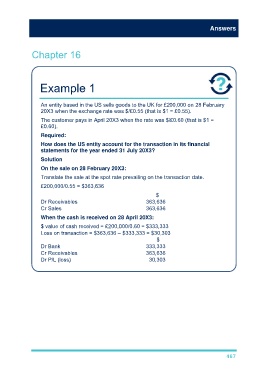

Exxampple 1

An entity baseed in the UUS sells gooods to thee UK for £200,000 on 28 Februaary

20XX3 when thhe exchangge rate was $/£0.55 (that is $1 = £0.55).

Thee customerr pays in AApril 20X3 wwhen the rrate was $//£0.60 (thaat is $1 =

£0.60).

Reqquired:

Howw does thhe US entitty accounnt for the transactionn in its finnancial

staatements ffor the yeaar ended 331 July 20XX3?

Sollution

On the sale oon 28 February 20XX3:

Traanslate the sale at thee spot ratee prevailingg on the traansaction ddate.

£2000,000/0.55 = $363,6636

$

Dr Receivablees 363,636

Cr SSales 363,636

Whhen the cash is receeived on 28 April 20X3:

$ vaalue of cassh receivedd = £200,0000/0.60 = $333,333

Losss on transsaction = $363,636 – $333,333 = $30,3033

$

Dr Bank 333,333

Cr Receivablees 363,636

Dr P/L (loss) 30,303

467