Page 221 - F2 Integrated Workbook STUDENT 2019

P. 221

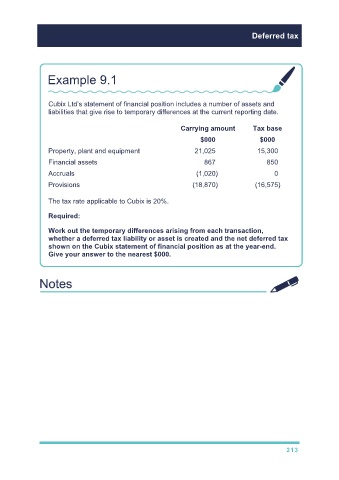

Deferred tax

Example 9.1

Cubix Ltd’s statement of financial position includes a number of assets and

liabilities that give rise to temporary differences at the current reporting date.

Carrying amount Tax base

$000 $000

Property, plant and equipment 21,025 15,300

Financial assets 867 850

Accruals (1,020) 0

Provisions (18,870) (16,575)

The tax rate applicable to Cubix is 20%.

Required:

Work out the temporary differences arising from each transaction,

whether a deferred tax liability or asset is created and the net deferred tax

shown on the Cubix statement of financial position as at the year-end.

Give your answer to the nearest $000.

213