Page 468 - F2 Integrated Workbook STUDENT 2019

P. 468

Chapter 19

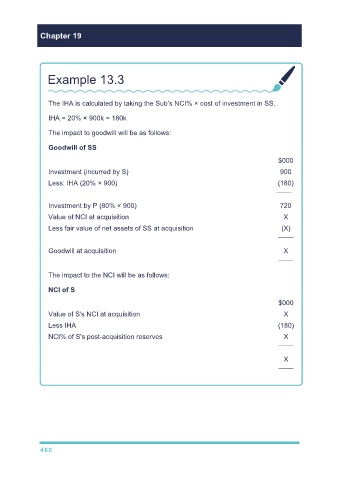

Example 13.3

The IHA is calculated by taking the Sub’s NCI% × cost of investment in SS.

IHA = 20% × 900k = 180k

The impact to goodwill will be as follows:

Goodwill of SS

$000

Investment (incurred by S) 900

Less: IHA (20% × 900) (180)

––––––

Investment by P (80% × 900) 720

Value of NCI at acquisition X

Less fair value of net assets of SS at acquisition (X)

––––––

Goodwill at acquisition X

––––––

The impact to the NCI will be as follows:

NCI of S

$000

Value of S's NCI at acquisition X

Less IHA (180)

NCI% of S's post-acquisition reserves X

––––––

X

––––––

460