Page 475 - F2 Integrated Workbook STUDENT 2019

P. 475

Answers

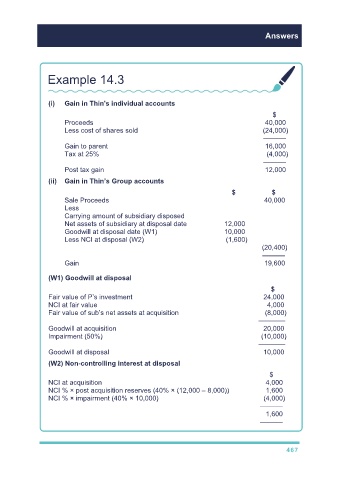

Example 14.3

(i) Gain in Thin's individual accounts

$

Proceeds 40,000

Less cost of shares sold (24,000)

––––––

Gain to parent 16,000

Tax at 25% (4,000)

––––––

Post tax gain 12,000

(ii) Gain in Thin’s Group accounts

$ $

Sale Proceeds 40,000

Less

Carrying amount of subsidiary disposed

Net assets of subsidiary at disposal date 12,000

Goodwill at disposal date (W1) 10,000

Less NCI at disposal (W2) (1,600)

(20,400)

––––––

Gain 19,600

(W1) Goodwill at disposal

$

Fair value of P’s investment 24,000

NCI at fair value 4,000

Fair value of sub’s net assets at acquisition (8,000)

–––––––

Goodwill at acquisition 20,000

Impairment (50%) (10,000)

–––––––

Goodwill at disposal 10,000

(W2) Non-controlling interest at disposal

$

NCI at acquisition 4,000

NCI % × post acquisition reserves (40% × (12,000 – 8,000)) 1,600

NCI % × impairment (40% × 10,000) (4,000)

––––––

1,600

––––––

467