Page 543 - F2 Integrated Workbook STUDENT 2019

P. 543

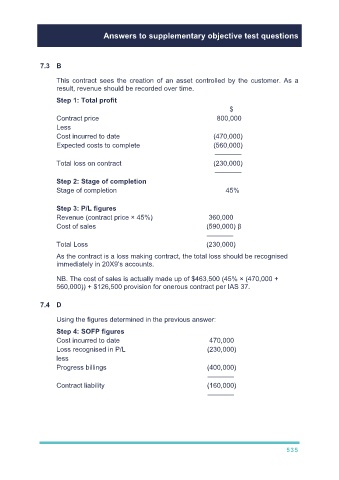

Answers to supplementary objective test questions

7.3 B

This contract sees the creation of an asset controlled by the customer. As a

result, revenue should be recorded over time.

Step 1: Total profit

$

Contract price 800,000

Less

Cost incurred to date (470,000)

Expected costs to complete (560,000)

–––––––

Total loss on contract (230,000)

–––––––

Step 2: Stage of completion

Stage of completion 45%

Step 3: P/L figures

Revenue (contract price × 45%) 360,000

Cost of sales (590,000) β

–––––––

Total Loss (230,000)

As the contract is a loss making contract, the total loss should be recognised

immediately in 20X9’s accounts.

NB. The cost of sales is actually made up of $463,500 (45% × (470,000 +

560,000)) + $126,500 provision for onerous contract per IAS 37.

7.4 D

Using the figures determined in the previous answer:

Step 4: SOFP figures

Cost incurred to date 470,000

Loss recognised in P/L (230,000)

less

Progress billings (400,000)

–––––––

Contract liability (160,000)

–––––––

535