Page 3 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 3

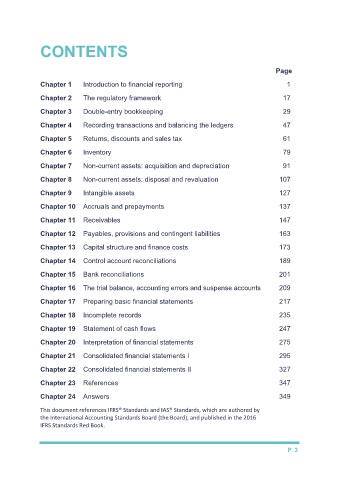

CONTENTS

Page

Chapter 1 Introduction to financial reporting 1

Chapter 2 The regulatory framework 17

Chapter 3 Double-entry bookkeeping 29

Chapter 4 Recording transactions and balancing the ledgers 47

Chapter 5 Returns, discounts and sales tax 61

Chapter 6 Inventory 79

Chapter 7 Non-current assets: acquisition and depreciation 91

Chapter 8 Non-current assets: disposal and revaluation 107

Chapter 9 Intangible assets 127

Chapter 10 Accruals and prepayments 137

Chapter 11 Receivables 147

Chapter 12 Payables, provisions and contingent liabilities 163

Chapter 13 Capital structure and finance costs 173

Chapter 14 Control account reconciliations 189

Chapter 15 Bank reconciliations 201

Chapter 16 The trial balance, accounting errors and suspense accounts 209

Chapter 17 Preparing basic financial statements 217

Chapter 18 Incomplete records 235

Chapter 19 Statement of cash flows 247

Chapter 20 Interpretation of financial statements 275

Chapter 21 Consolidated financial statements I 295

Chapter 22 Consolidated financial statements II 327

Chapter 23 References 347

Chapter 24 Answers 349

This document references IFRS® Standards and IAS® Standards, which are authored by

the International Accounting Standards Board (the Board), and published in the 2016

IFRS Standards Red Book.

P.3