Page 356 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 356

Chapter 24

Chapter 3

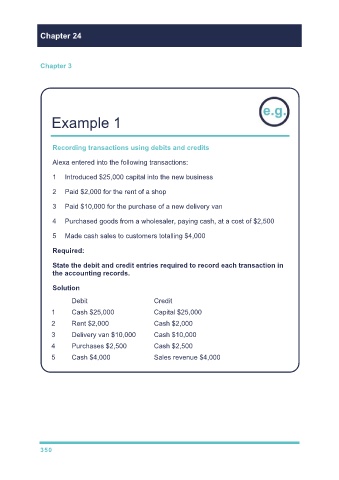

Example 1

Recording transactions using debits and credits

Alexa entered into the following transactions:

1 Introduced $25,000 capital into the new business

2 Paid $2,000 for the rent of a shop

3 Paid $10,000 for the purchase of a new delivery van

4 Purchased goods from a wholesaler, paying cash, at a cost of $2,500

5 Made cash sales to customers totalling $4,000

Required:

State the debit and credit entries required to record each transaction in

the accounting records.

Solution

Debit Credit

1 Cash $25,000 Capital $25,000

2 Rent $2,000 Cash $2,000

3 Delivery van $10,000 Cash $10,000

4 Purchases $2,500 Cash $2,500

5 Cash $4,000 Sales revenue $4,000

350