Page 400 - F3 -FA Integrated Workbook STUDENT 2018-19

P. 400

Chapter 24

Chapter 18

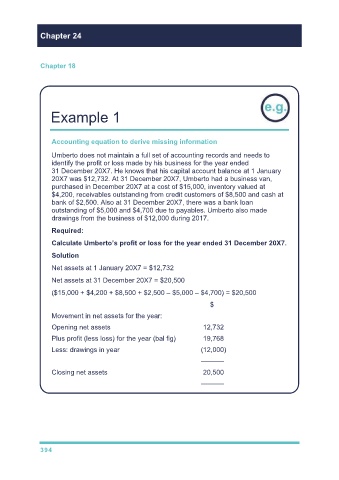

Example 1

Accounting equation to derive missing information

Umberto does not maintain a full set of accounting records and needs to

identify the profit or loss made by his business for the year ended

31 December 20X7. He knows that his capital account balance at 1 January

20X7 was $12,732. At 31 December 20X7, Umberto had a business van,

purchased in December 20X7 at a cost of $15,000, inventory valued at

$4,200, receivables outstanding from credit customers of $8,500 and cash at

bank of $2,500. Also at 31 December 20X7, there was a bank loan

outstanding of $5,000 and $4,700 due to payables. Umberto also made

drawings from the business of $12,000 during 2017.

Required:

Calculate Umberto’s profit or loss for the year ended 31 December 20X7.

Solution

Net assets at 1 January 20X7 = $12,732

Net assets at 31 December 20X7 = $20,500

($15,000 + $4,200 + $8,500 + $2,500 – $5,000 – $4,700) = $20,500

$

Movement in net assets for the year:

Opening net assets 12,732

Plus profit (less loss) for the year (bal fig) 19,768

Less: drawings in year (12,000)

––––––

Closing net assets 20,500

––––––

394