Page 328 - PM Integrated Workbook 2018-19

P. 328

Chapter 12

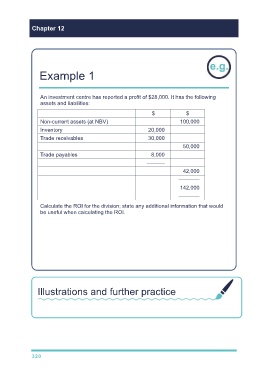

Example 1

An investment centre has reported a profit of $28,000. It has the following

assets and liabilities:

$ $

Non-current assets (at NBV) 100,000

Inventory 20,000

Trade receivables 30,000

50,000

Trade payables 8,000

––––––

42,000

–––––––

142,000

–––––––

Calculate the ROI for the division; state any additional information that would

be useful when calculating the ROI.ROI might be measured as:

$28,000/$142,000 = 19.7%.

However, suppose that the centre manager has no responsibility for debt

collection. In this situation, it could be argued that the centre manager is not

responsible for trade receivable, and the centre’s capital employed should be

$112,000.

If this assumption is used, ROI would be $28,000/$112,000 = 25%.

Illustrations and further practice

Now try the additional example on ROI.

320