Page 380 - PM Integrated Workbook 2018-19

P. 380

Chapter 15

Chapter 3

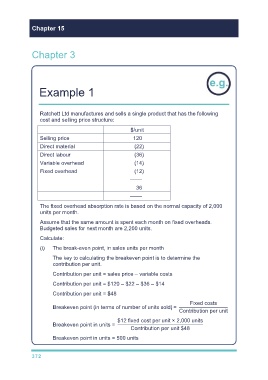

Example 1

Ratchett Ltd manufactures and sells a single product that has the following

cost and selling price structure:

$/unit

Selling price 120

Direct material (22)

Direct labour (36)

Variable overhead (14)

Fixed overhead (12)

––––

36

––––

The fixed overhead absorption rate is based on the normal capacity of 2,000

units per month.

Assume that the same amount is spent each month on fixed overheads.

Budgeted sales for next month are 2,200 units.

Calculate:

(i) The break-even point, in sales units per month

The key to calculating the breakeven point is to determine the

contribution per unit.

Contribution per unit = sales price – variable costs

Contribution per unit = $120 – $22 – $36 – $14

Contribution per unit = $48

Fixed costs

Breakeven point (in terms of number of units sold) =

Contribution per unit

$12 fixed cost per unit × 2,000 units

Breakeven point in units =

Contribution per unit $48

Breakeven point in units = 500 units

372