Page 24 - PowerPoint Presentation

P. 24

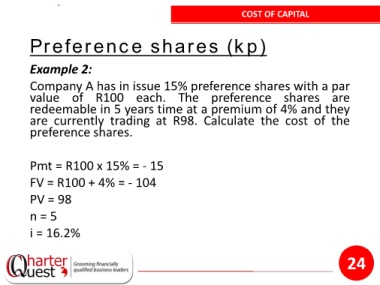

COST OF CAPITAL

Preference shares (kp)

Example 2:

Company A has in issue 15% preference shares with a par

value of R100 each. The preference shares are

redeemable in 5 years time at a premium of 4% and they

are currently trading at R98. Calculate the cost of the

preference shares.

Pmt = R100 x 15% = - 15

FV = R100 + 4% = - 104

PV = 98

n = 5

i = 16.2%

24