Page 14 - PowerPoint Presentation

P. 14

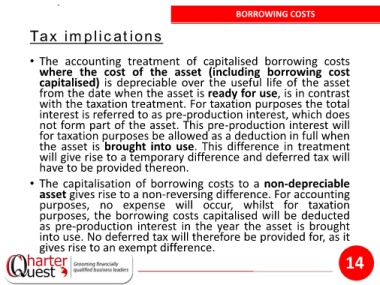

BORROWING COSTS

Tax implications

• The accounting treatment of capitalised borrowing costs

where the cost of the asset (including borrowing cost

capitalised) is depreciable over the useful life of the asset

from the date when the asset is ready for use, is in contrast

with the taxation treatment. For taxation purposes the total

interest is referred to as pre-production interest, which does

not form part of the asset. This pre-production interest will

for taxation purposes be allowed as a deduction in full when

the asset is brought into use. This difference in treatment

will give rise to a temporary difference and deferred tax will

have to be provided thereon.

• The capitalisation of borrowing costs to a non-depreciable

asset gives rise to a non-reversing difference. For accounting

purposes, no expense will occur, whilst for taxation

purposes, the borrowing costs capitalised will be deducted

as pre-production interest in the year the asset is brought

into use. No deferred tax will therefore be provided for, as it

gives rise to an exempt difference.

14