Page 4 - PowerPoint Presentation

P. 4

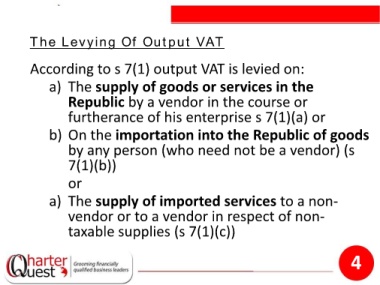

The Levying Of Output VAT

According to s 7(1) output VAT is levied on:

a) The supply of goods or services in the

Republic by a vendor in the course or

furtherance of his enterprise s 7(1)(a) or

b) On the importation into the Republic of goods

by any person (who need not be a vendor) (s

7(1)(b))

or

a) The supply of imported services to a non-

vendor or to a vendor in respect of non-

taxable supplies (s 7(1)(c))

4