Page 64 - Microsoft Word - 00 Prelims.docx

P. 64

Chapter 3

The development of corporate

governance codes

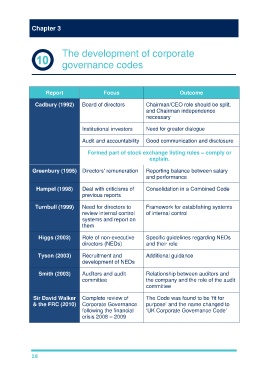

Report Focus Outcome

Cadbury (1992) Board of directors Chairman/CEO role should be split,

and Chairman independence

necessary

Institutional investors Need for greater dialogue

Audit and accountability Good communication and disclosure

Formed part of stock exchange listing rules – comply or

explain.

Greenbury (1995) Directors' remuneration Reporting balance between salary

and performance

Hampel (1998) Deal with criticisms of Consolidation in a Combined Code

previous reports

Turnbull (1999) Need for directors to Framework for establishing systems

review internal control of internal control

systems and report on

them

Higgs (2003) Role of non-executive Specific guidelines regarding NEDs

directors (NEDs) and their role

Tyson (2003) Recruitment and Additional guidance

development of NEDs

Smith (2003) Auditors and audit Relationship between auditors and

committee the company and the role of the audit

committee

Sir David Walker Complete review of The Code was found to be ‘fit for

& the FRC (2010) Corporate Governance purpose’ and the name changed to

following the financial ‘UK Corporate Governance Code’

crisis 2008 – 2009

58