Page 7 - PowerPoint Presentation

P. 7

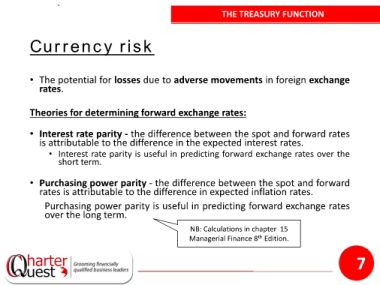

THE TREASURY FUNCTION

Currency risk

• The potential for losses due to adverse movements in foreign exchange

rates.

Theories for determining forward exchange rates:

• Interest rate parity - the difference between the spot and forward rates

is attributable to the difference in the expected interest rates.

• Interest rate parity is useful in predicting forward exchange rates over the

short term.

• Purchasing power parity - the difference between the spot and forward

rates is attributable to the difference in expected inflation rates.

Purchasing power parity is useful in predicting forward exchange rates

over the long term.

NB: Calculations in chapter 15

Managerial Finance 8 Edition.

th

7