Page 11 - PowerPoint Presentation

P. 11

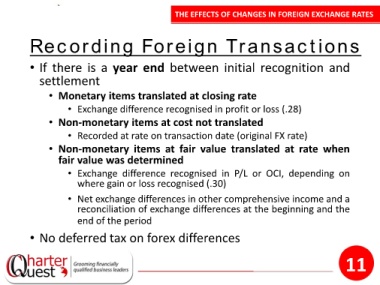

THE EFFECTS OF CHANGES IN FOREIGN EXCHANGE RATES

Recording Foreign Transactions

• If there is a year end between initial recognition and

settlement

• Monetary items translated at closing rate

• Exchange difference recognised in profit or loss (.28)

• Non-monetary items at cost not translated

• Recorded at rate on transaction date (original FX rate)

• Non-monetary items at fair value translated at rate when

fair value was determined

• Exchange difference recognised in P/L or OCI, depending on

where gain or loss recognised (.30)

• Net exchange differences in other comprehensive income and a

reconciliation of exchange differences at the beginning and the

end of the period

• No deferred tax on forex differences

11