Page 15 - P6 Slide Taxation - Lecture Day 2 - Donations tax and Estate duty.

P. 15

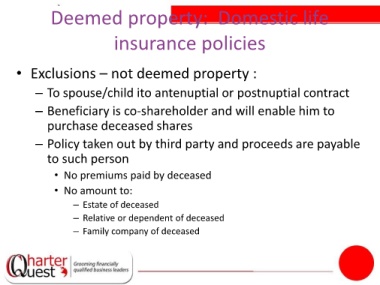

Deemed property: Domestic life

insurance policies

• Exclusions – not deemed property :

– To spouse/child ito antenuptial or postnuptial contract

– Beneficiary is co-shareholder and will enable him to

purchase deceased shares

– Policy taken out by third party and proceeds are payable

to such person

• No premiums paid by deceased

• No amount to:

– Estate of deceased

– Relative or dependent of deceased

– Family company of deceased