Page 39 - P6 Slide Taxation - Lecture Day 2 - Donations tax and Estate duty.

P. 39

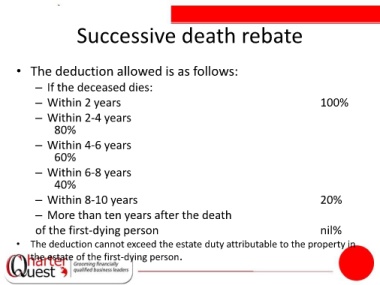

Successive death rebate

• The deduction allowed is as follows:

– If the deceased dies:

– Within 2 years 100%

– Within 2-4 years

80%

– Within 4-6 years

60%

– Within 6-8 years

40%

– Within 8-10 years 20%

– More than ten years after the death

of the first-dying person nil%

• The deduction cannot exceed the estate duty attributable to the property in

the estate of the first-dying person.