Page 6 - P6 Slide Taxation - Lecture Day 2 - Donations tax and Estate duty.

P. 6

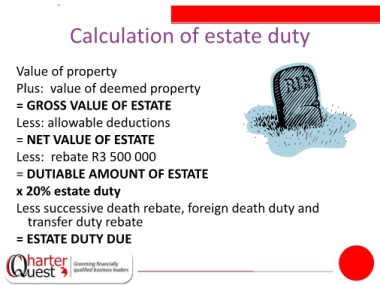

Calculation of estate duty

Value of property

Plus: value of deemed property

= GROSS VALUE OF ESTATE

Less: allowable deductions

= NET VALUE OF ESTATE

Less: rebate R3 500 000

= DUTIABLE AMOUNT OF ESTATE

x 20% estate duty

Less successive death rebate, foreign death duty and

transfer duty rebate

= ESTATE DUTY DUE