Page 65 - PowerPoint Presentation

P. 65

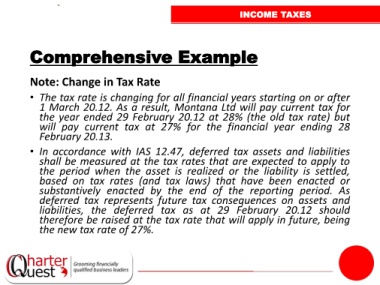

INCOME TAXES

Comprehensive Example

Note: Change in Tax Rate

• The tax rate is changing for all financial years starting on or after

1 March 20.12. As a result, Montana Ltd will pay current tax for

the year ended 29 February 20.12 at 28% (the old tax rate) but

will pay current tax at 27% for the financial year ending 28

February 20.13.

• In accordance with IAS 12.47, deferred tax assets and liabilities

shall be measured at the tax rates that are expected to apply to

the period when the asset is realized or the liability is settled,

based on tax rates (and tax laws) that have been enacted or

substantively enacted by the end of the reporting period. As

deferred tax represents future tax consequences on assets and

liabilities, the deferred tax as at 29 February 20.12 should

therefore be raised at the tax rate that will apply in future, being

the new tax rate of 27%.