Page 19 - Finac1 Test 3 slides - 2. Intangible Assets

P. 19

TEST 3 PREPARATION

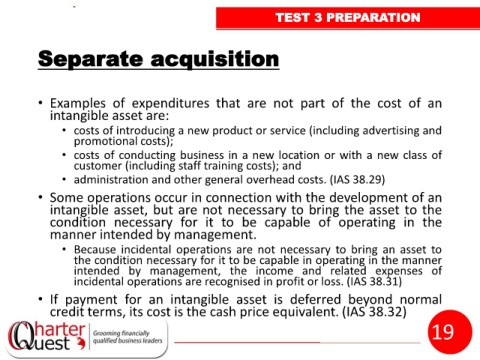

Separate acquisition

• Examples of expenditures that are not part of the cost of an

intangible asset are:

• costs of introducing a new product or service (including advertising and

promotional costs);

• costs of conducting business in a new location or with a new class of

customer (including staff training costs); and

• administration and other general overhead costs. (IAS 38.29)

• Some operations occur in connection with the development of an

intangible asset, but are not necessary to bring the asset to the

condition necessary for it to be capable of operating in the

manner intended by management.

• Because incidental operations are not necessary to bring an asset to

the condition necessary for it to be capable in operating in the manner

intended by management, the income and related expenses of

incidental operations are recognised in profit or loss. (IAS 38.31)

• If payment for an intangible asset is deferred beyond normal

credit terms, its cost is the cash price equivalent. (IAS 38.32)

19