Page 6 - Taxation Test 4 Slides - Provisional Tax & Estate Duty

P. 6

EMPLOYEE’S TAX & PROVISIONAL TAX

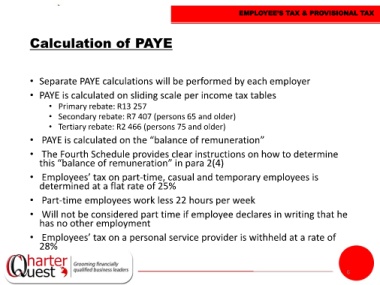

Calculation of PAYE

• Separate PAYE calculations will be performed by each employer

• PAYE is calculated on sliding scale per income tax tables

• Primary rebate: R13 257

• Secondary rebate: R7 407 (persons 65 and older)

• Tertiary rebate: R2 466 (persons 75 and older)

• PAYE is calculated on the “balance of remuneration”

• The Fourth Schedule provides clear instructions on how to determine

this “balance of remuneration” in para 2(4)

• Employees’ tax on part-time, casual and temporary employees is

determined at a flat rate of 25%

• Part-time employees work less 22 hours per week

• Will not be considered part time if employee declares in writing that he

has no other employment

• Employees’ tax on a personal service provider is withheld at a rate of

28%

6