Page 7 - PowerPoint Presentation

P. 7

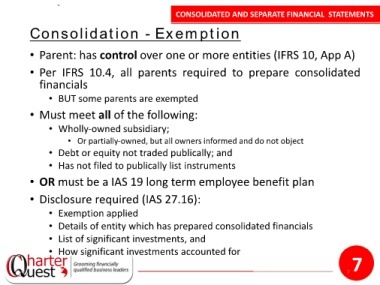

CONSOLIDATED AND SEPARATE FINANCIAL STATEMENTS

Consolidation - Exemption

• Parent: has control over one or more entities (IFRS 10, App A)

• Per IFRS 10.4, all parents required to prepare consolidated

financials

• BUT some parents are exempted

• Must meet all of the following:

• Wholly-owned subsidiary;

• Or partially-owned, but all owners informed and do not object

• Debt or equity not traded publically; and

• Has not filed to publically list instruments

• OR must be a IAS 19 long term employee benefit plan

• Disclosure required (IAS 27.16):

• Exemption applied

• Details of entity which has prepared consolidated financials

• List of significant investments, and

• How significant investments accounted for

7

7