Page 23 - PowerPoint Presentation

P. 23

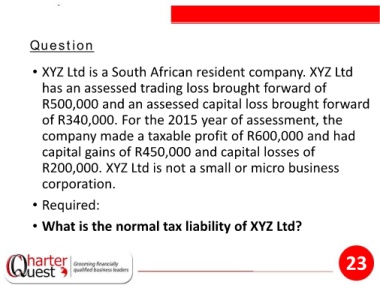

Question

• XYZ Ltd is a South African resident company. XYZ Ltd

has an assessed trading loss brought forward of

R500,000 and an assessed capital loss brought forward

of R340,000. For the 2015 year of assessment, the

company made a taxable profit of R600,000 and had

capital gains of R450,000 and capital losses of

R200,000. XYZ Ltd is not a small or micro business

corporation.

• Required:

• What is the normal tax liability of XYZ Ltd?

23