Page 169 - AA Integrated Workbook STUDENT 2018-19

P. 169

Procedures

Directional testing

2.1 Directional testing

The concept of directional testing derives from the principle of double-entry

bookkeeping, i.e. for every debit there should be a corresponding credit.

Therefore any misstatement of a debit entry will also result in a misstatement of a

credit entry.

The auditor will primarily test debit entries (assets and expenses) for overstatement

and credit entries (liabilities and income) for understatement.

Testing for understatement tests completeness.

Testing for overstatement tests valuation, existence, rights and obligations, and

occurrence.

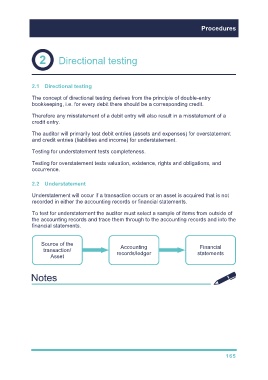

2.2 Understatement

Understatement will occur if a transaction occurs or an asset is acquired that is not

recorded in either the accounting records or financial statements.

To test for understatement the auditor must select a sample of items from outside of

the accounting records and trace them through to the accounting records and into the

financial statements.

Source of the

transaction/ Accounting Financial

Asset records/ledger statements

165