Page 81 - AA Integrated Workbook STUDENT 2018-19

P. 81

Planning

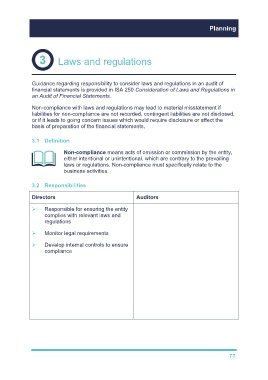

Laws and regulations

Guidance regarding responsibility to consider laws and regulations in an audit of

financial statements is provided in ISA 250 Consideration of Laws and Regulations in

an Audit of Financial Statements.

Non-compliance with laws and regulations may lead to material misstatement if

liabilities for non-compliance are not recorded, contingent liabilities are not disclosed,

or if it leads to going concern issues which would require disclosure or affect the

basis of preparation of the financial statements.

3.1 Definition

Non-compliance means acts of omission or commission by the entity,

either intentional or unintentional, which are contrary to the prevailing

laws or regulations. Non-compliance must specifically relate to the

business activities.

3.2 Responsibilities

Directors Auditors

Responsible for ensuring the entity Obtain sufficient appropriate

complies with relevant laws and evidence of compliance with laws

regulations and regulations generally

recognised to have a direct effect

Monitor legal requirements on the financial statements (e.g.

accounting standards)

Develop internal controls to ensure

compliance Perform specified procedures to

help identify instances of non-

compliance with other laws and

regulations that may have a

material effect on the financial

statements (e.g. health & safety

regulations)

Respond appropriately if non-

compliance is identified or

suspected

77