Page 119 - MAC4861_2 Costing Class Slides Part 1

P. 119

TEST 3 - COSTING

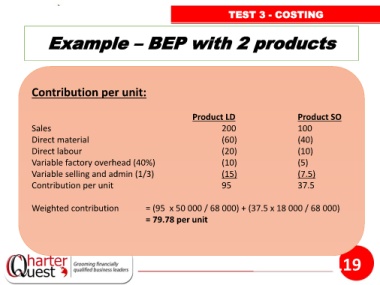

Example – BEP with 2 products

Contribution per unit:

Product LD Product SO

Sales 200 100

Direct material (60) (40)

Direct labour (20) (10)

Variable factory overhead (40%) (10) (5)

Variable selling and admin (1/3) (15) (7.5)

Contribution per unit 95 37.5

Weighted contribution = (95 x 50 000 / 68 000) + (37.5 x 18 000 / 68 000)

= 79.78 per unit

119