Page 17 - Chapter 23 - Interest

P. 17

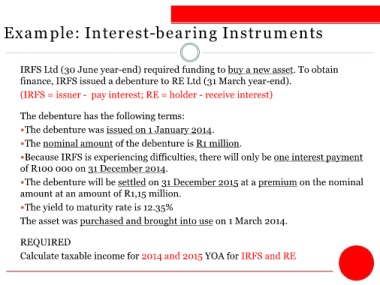

Example: Interest-bearing Instruments

IRFS Ltd (30 June year-end) required funding to buy a new asset. To obtain

finance, IRFS issued a debenture to RE Ltd (31 March year-end).

(IRFS = issuer - pay interest; RE = holder - receive interest)

The debenture has the following terms:

The debenture was issued on 1 January 2014.

The nominal amount of the debenture is R1 million.

Because IRFS is experiencing difficulties, there will only be one interest payment

of R100 000 on 31 December 2014.

The debenture will be settled on 31 December 2015 at a premium on the nominal

amount at an amount of R1,15 million.

The yield to maturity rate is 12.35%

The asset was purchased and brought into use on 1 March 2014.

REQUIRED

Calculate taxable income for 2014 and 2015 YOA for IRFS and RE