Page 22 - OCS Workbook - Day 2 Suggested Solutions (May 2018)

P. 22

CIMA MAY 2018 – OPERATIONAL CASE STUDY

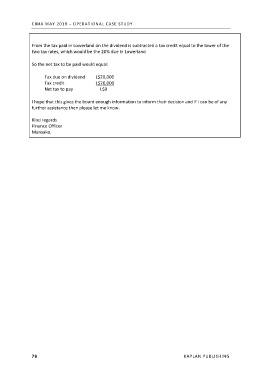

From the tax paid in Lowerland on the dividend is subtracted a tax credit equal to the lower of the

two tax rates, which would be the 20% due in Lowerland

So the net tax to be paid would equal:

Tax due on dividend L$20,000

Tax credit L$20,000

Net tax to pay L$0

I hope that this gives the board enough information to inform their decision and if I can be of any

further assistance then please let me know.

Kind regards

Finance Officer

Mansako.

78 KAPLAN PUBLISHING