Page 13 - Manac Costing Test 2 class slides - 4. Transfer Pricing

P. 13

TRANSFER PRICING

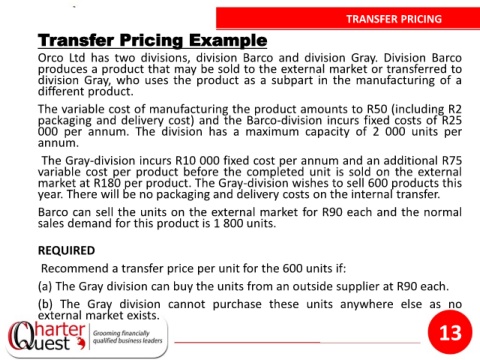

Transfer Pricing Example

Orco Ltd has two divisions, division Barco and division Gray. Division Barco

produces a product that may be sold to the external market or transferred to

division Gray, who uses the product as a subpart in the manufacturing of a

different product.

The variable cost of manufacturing the product amounts to R50 (including R2

packaging and delivery cost) and the Barco-division incurs fixed costs of R25

000 per annum. The division has a maximum capacity of 2 000 units per

annum.

The Gray-division incurs R10 000 fixed cost per annum and an additional R75

variable cost per product before the completed unit is sold on the external

market at R180 per product. The Gray-division wishes to sell 600 products this

year. There will be no packaging and delivery costs on the internal transfer.

Barco can sell the units on the external market for R90 each and the normal

sales demand for this product is 1 800 units.

REQUIRED

Recommend a transfer price per unit for the 600 units if:

(a) The Gray division can buy the units from an outside supplier at R90 each.

(b) The Gray division cannot purchase these units anywhere else as no

external market exists.

13