Page 19 - FINAL CFA I SLIDES JUNE 2019 DAY 7

P. 19

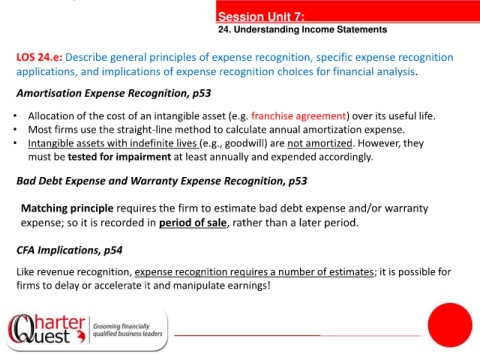

Session Unit 7:

24. Understanding Income Statements

LOS 24.e: Describe general principles of expense recognition, specific expense recognition

applications, and implications of expense recognition choices for financial analysis.

Amortisation Expense Recognition, p53

• Allocation of the cost of an intangible asset (e.g. franchise agreement) over its useful life.

• Most firms use the straight-line method to calculate annual amortization expense.

• Intangible assets with indefinite lives (e.g., goodwill) are not amortized. However, they

tanties

must be tested for impairment at least annually and expended accordingly.

Bad Debt Expense and Warranty Expense Recognition, p53

Matching principle requires the firm to estimate bad debt expense and/or warranty

expense; so it is recorded in period of sale, rather than a later period.

CFA Implications, p54

Like revenue recognition, expense recognition requires a number of estimates; it is possible for

firms to delay or accelerate it and manipulate earnings!