Page 32 - FINAL CFA I SLIDES JUNE 2019 DAY 7

P. 32

Session Unit 7:

24. Understanding Income Statements

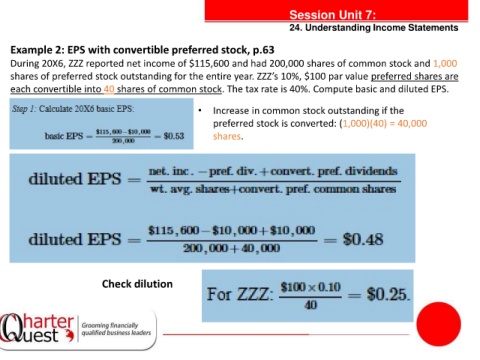

Example 2: EPS with convertible preferred stock, p.63

During 20X6, ZZZ reported net income of $115,600 and had 200,000 shares of common stock and 1,000

shares of preferred stock outstanding for the entire year. ZZZ’s 10%, $100 par value preferred shares are

each convertible into 40 shares of common stock. The tax rate is 40%. Compute basic and diluted EPS.

• Increase in common stock outstanding if the

preferred stock is converted: (1,000)(40) = 40,000

shares.

tanties

Check dilution