Page 5 - FINAL CFA I SLIDES JUNE 2019 DAY 7

P. 5

Session Unit 7:

24. Understanding Income Statements

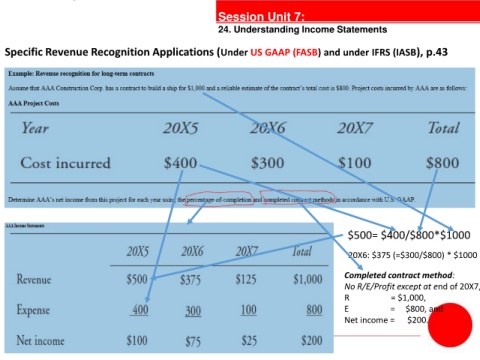

Specific Revenue Recognition Applications (Under US GAAP (FASB) and under IFRS (IASB), p.43

tanties

$500= $400/$800*$1000

20X6: $375 (=$300/$800) * $1000

Completed contract method:

No R/E/Profit except at end of 20X7,

R = $1,000,

E = $800, and

Net income = $200.