Page 75 - FINAL CFA I SLIDES JUNE 2019 DAY 7

P. 75

Session Unit 7:

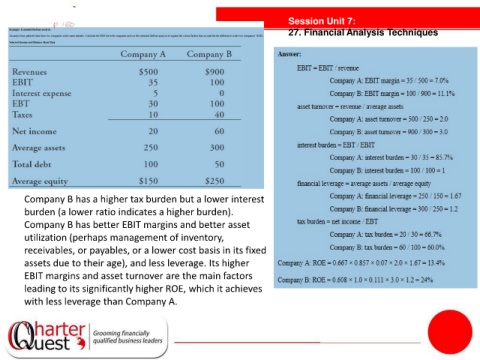

27. Financial Analysis Techniques

tanties

Company B has a higher tax burden but a lower interest

burden (a lower ratio indicates a higher burden).

Company B has better EBIT margins and better asset

utilization (perhaps management of inventory,

receivables, or payables, or a lower cost basis in its fixed

assets due to their age), and less leverage. Its higher

EBIT margins and asset turnover are the main factors

leading to its significantly higher ROE, which it achieves

with less leverage than Company A.

(